monterey county property tax calculator

435 Main Rd PO. The median property tax on a 56630000 house is 594615 in the United States.

What Are The Advantages Of Investing In Real Estate Everyone Should Own At Least One House Or A Piece Of Real Estate Investing Real Estate Investor Investing

Please feel free to enter specific property tax for more accurate estimate.

. We use state and national averages when estimating your property insurance. Town of Monterey MA. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year.

As far as other cities towns and locations go the place with the highest sales tax rate is Greenfield and the place with the lowest sales tax rate is Aromas. Monterey County Treasurer. 1-831-755-5057 - Monterey County Tax Collectors main telephone number.

Box 308 Monterey MA 01245 Phone. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Like taxes though homeowners insurance costs can greatly vary from place to place.

435 Main Rd PO. Choose Option 3 to pay taxes. Per 1000 Property Value Total.

The median property tax on a 56630000 house is 419062 in California. The median property tax on a 56630000 house is 594615 in the United States. The most populous location in Monterey County California is Salinas.

Box 308 Monterey MA 01245 Phone. The state relies on real estate tax revenues a lot. Sewage treatment plants and athletic parks with all dependent on the real property tax.

1-800-491-8003 - Direct line to ACI Payments Inc. Normally local school districts are a significant draw on property tax funds. Search For Title Tax Pre-Foreclosure Info Today.

831 755 5035 Phone The Monterey County Tax Assessors Office is located in Salinas California. Monterey County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property. Get driving directions to this office.

Monterey County Property Records are real estate documents that contain information related to real property in Monterey County California. 168 West Alisal Street. Find All The Record Information You Need Here.

The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. Normally local school districts are a significant draw on property tax funds. Salinas California 93902.

The most populous zip code in Monterey County California is 93906. Ad Enter Any Address Receive a Comprehensive Property Report. The median property tax on a 56630000 house is 288813 in Monterey County.

California Property Tax Calculator. Town of Monterey MA. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The program has extended assistance to cover. Monterey County has one of the highest median property taxes in the United States and is ranked 178th of the 3143 counties in order of median property taxes. Just type in the exact address in the search bar below and instantly know the targeted propertys bill for the latest tax year.

Easily run a rapid Monterey County CA property tax search. Revenue Tax Code Section 11911-11929. MONTEREY COUNTY Monterey County residents who need help after falling behind on house payments during the Covid-19 pandemic can still get assistance through the California Mortgage Relief Program which is expanding eligibility requirements to help more homeowners catch up on past-due payments and get a fresh start.

You will need your 12-digit ASMT number found on your tax bill to make payments by phone. Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established. 14 rows Per 1000 Property Value City Rate.

See Results in Minutes. As computed a composite tax rate times the market value total will provide the countys entire tax burden and include individual taxpayers share. Search for your current Monterey County property tax statements and pay them online using this service.

AZ CA HI NV OH OR WA. The Monterey County Sales Tax is collected by the merchant on all qualifying sales made. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

In-depth Monterey County CA Property Tax Information. That is nearly double the national median. Monterey County collects on average 051 of a propertys assessed fair market value as property tax.

Alameda Alpine Amador Butte Calaveras Colusa Contra Costa Del Norte El Dorado Fresno Glenn Humboldt Imperial Inyo Kern Kings Lake Lassen Los Angeles Madera Marin Mariposa Mendocino Merced Modoc Mono Monterey Napa Nevada Orange Placer Plumas Riverside Sacramento. If you choose to pay your property tax by mail please send mail to the below address. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value.

Payments may be made using Visa MasterCard Discover American Express or through an electronic checking or savings debit. This calculator can only provide you with a rough estimate of your tax liabilities based on the. Understand Monterey County California Closing Costs and Fees.

Ad Be Your Own Property Detective. Not only for Monterey County and cities but down to special-purpose districts as well eg. This table shows the total sales tax.

Unsure Of The Value Of Your Property. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. California has a 6 sales tax and Monterey County collects an additional 025 so the minimum sales tax rate in Monterey County is 625 not including any city or special district taxes.

The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services in the collection of property taxes finesfees banking and investment services. They are maintained by various government. Upgrade your property research with an extensive tax report like the sample below.

Property Taxes In Placer County Go Where Roseville Today

Property Tax By County Property Tax Calculator Rethority

Property Tax By County Property Tax Calculator Rethority

California Public Records Public Records California Public

Property Tax By County Property Tax Calculator Rethority

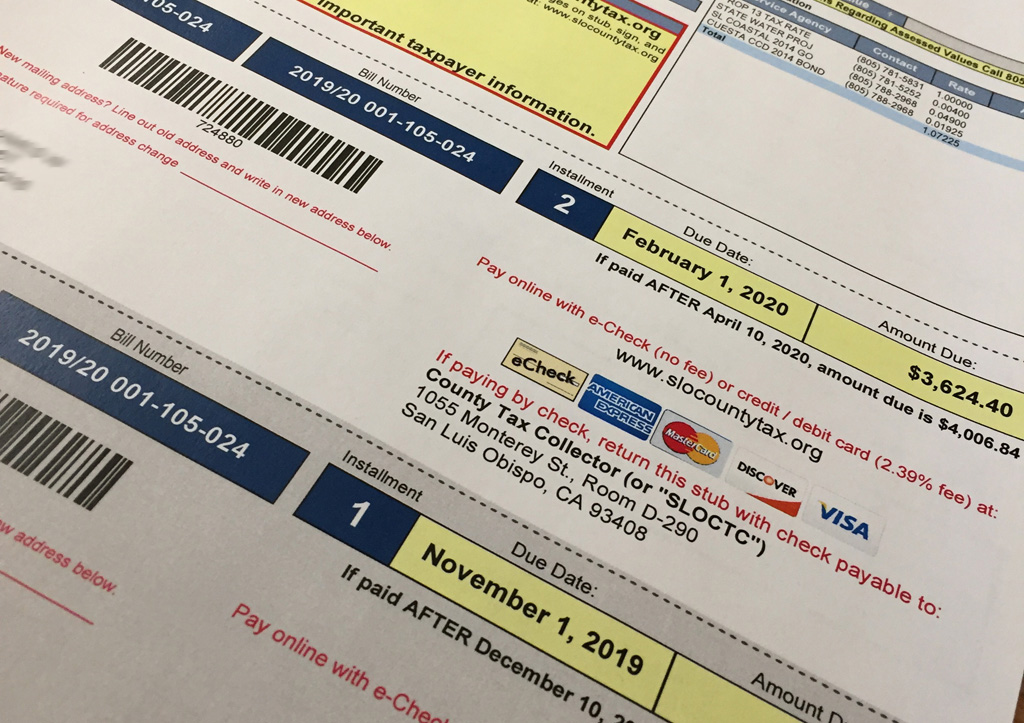

First Installment Payments For 2019 20 Secured Property Tax Bills Are Due November 1st County Of San Luis Obispo

Property Tax California H R Block

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Property Tax By County Property Tax Calculator Rethority

Property Tax Bill Stege Sanitary District

How To Calculate Property Tax And How To Estimate Property Taxes

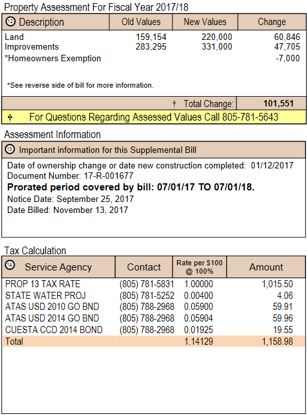

How To Read Your Supplemental Tax Bill County Of San Luis Obispo